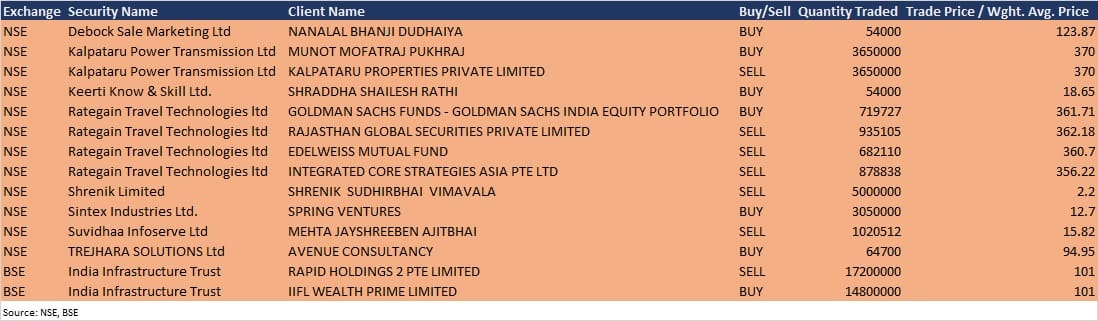

Goldman Sachs Funds has increased shareholding in Rategain Travel Technologies to 2 percent from 1.32 percent earlier, via an open market transaction on December 17, the listing day.

Goldman Sachs Funds - Goldman Sachs India Equity Portfolio acquired 7,19,727 equity shares in the company (0.67 percent of total paid-up equity) at Rs 361.71 per share. The global fund house had bought a 1.32 percent stake via Rategain's public issue last week.

However, Rajasthan Global Securities sold 9,35,105 equity shares in Rategain at Rs 362.18 per share. Edelweiss Mutual Fund also offloaded 6,82,110 equity shares at Rs 360.7 per share, while Integrated Core Strategies Asia Pte sold 8,78,838 equity shares at Rs 356.22 per share on the NSE, the bulk deals data showed.

Integrated Core Strategies Asia Pte had held a 1.14 percent stake or 12.12 lakh shares in Rategain as per the shareholding pattern available in the exchange filing.

Travel and hospitality solutions provider Rategain Travel Technologies was down 20 percent on debut, to close at Rs 340.05 on the NSE.

Spring Ventures bought 30.5 lakh equity shares in Sintex Industries at Rs 12.7 per share on the NSE.

Rapid Holdings 2 Pte Limited sold 1.72 crore equity shares in India Infrastructure Trust at Rs 101 per share. However, IIFL Wealth Prime Limited bought 1.48 crore equity shares in the company at the same price on the BSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.